UpPass takes care of the heavy lifting, automatically transforming user data into a signed PDF for hassle-free compliance reporting.

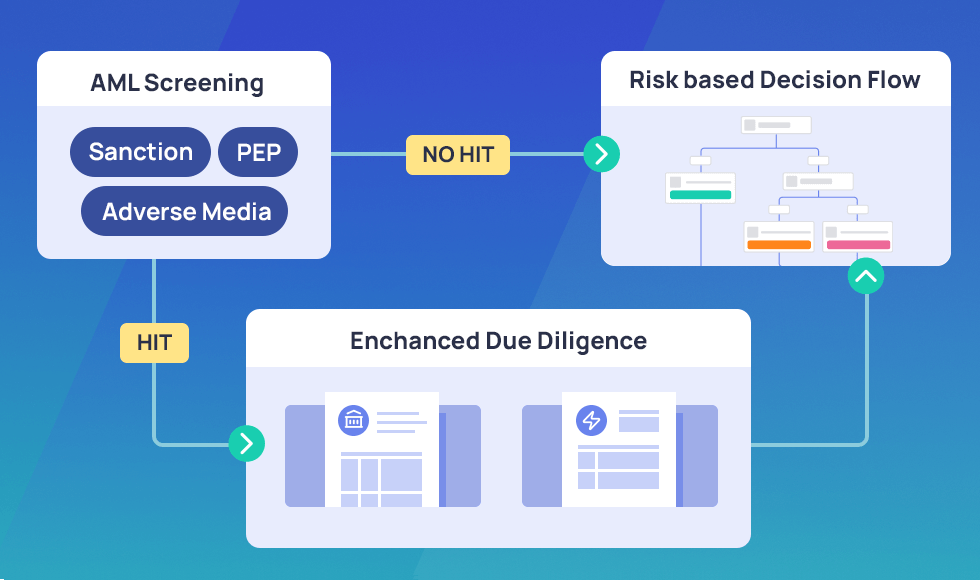

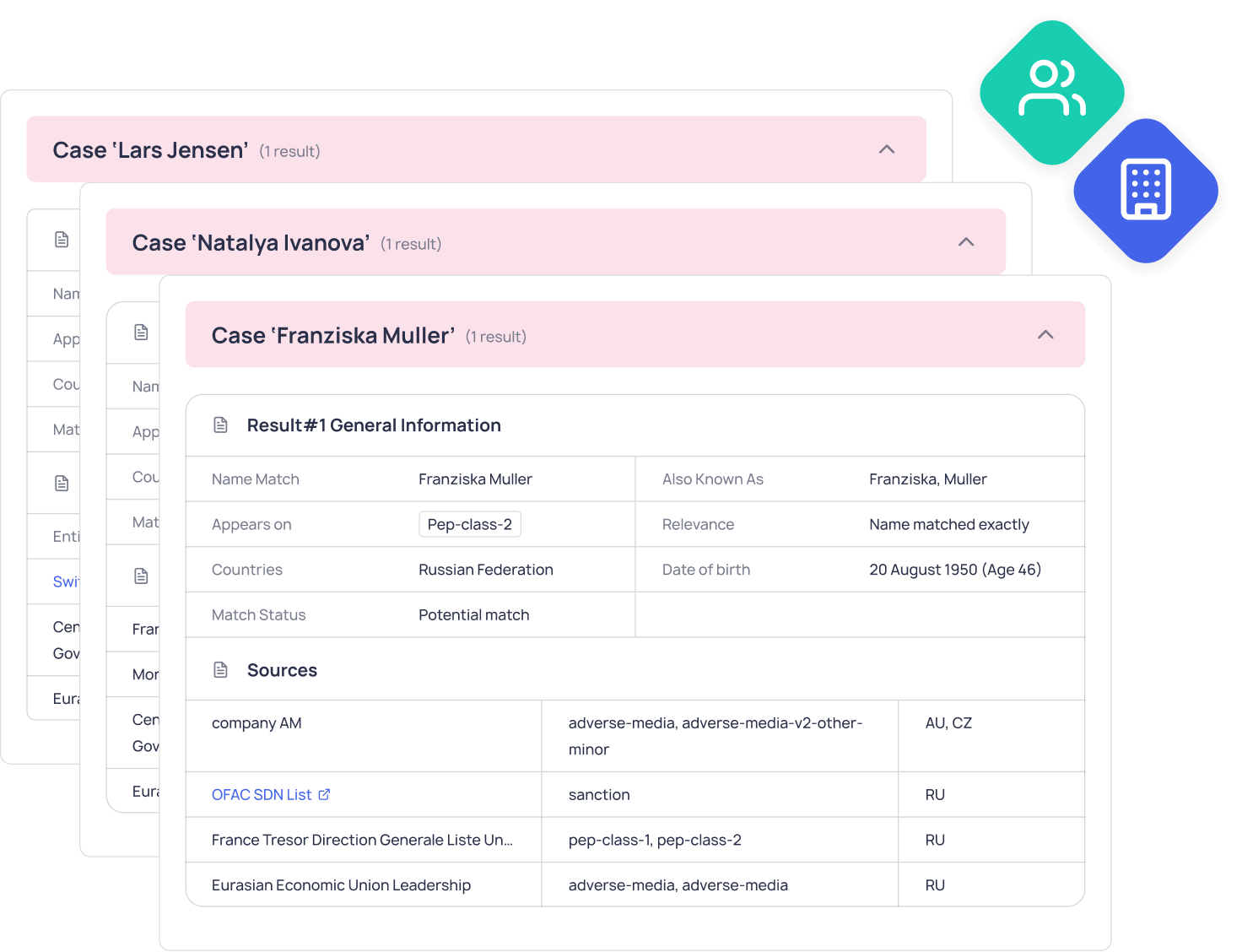

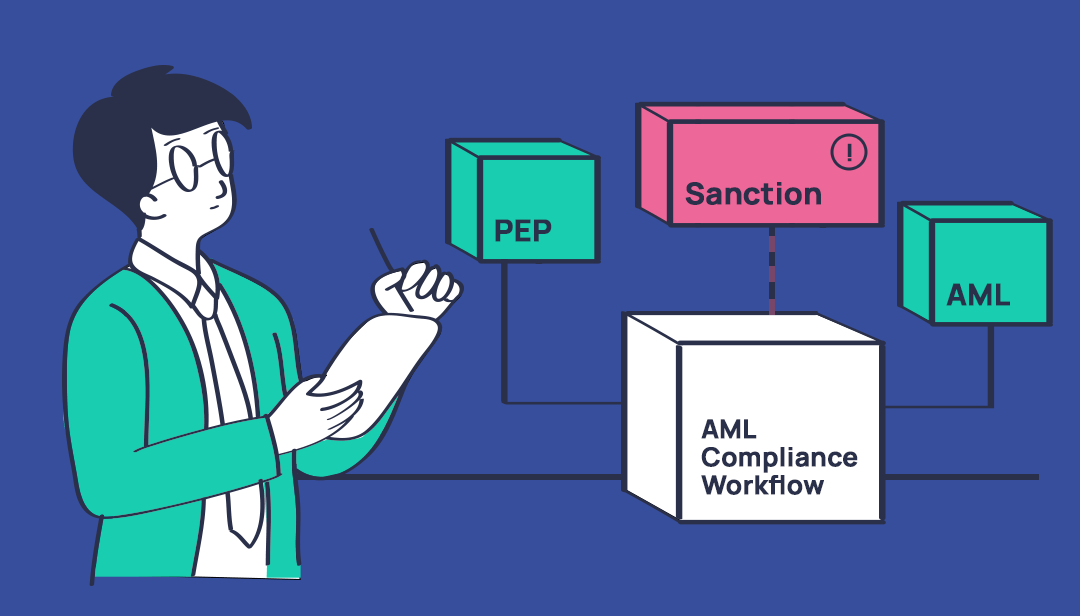

Say goodbye to Manual AML check

and High Risk Due Diligence

Automate Enhanced Customer Due Diligence

Streamline for success by automating your ECDD process end-to-end, establishing accurate AML monitoring and financial transparency.

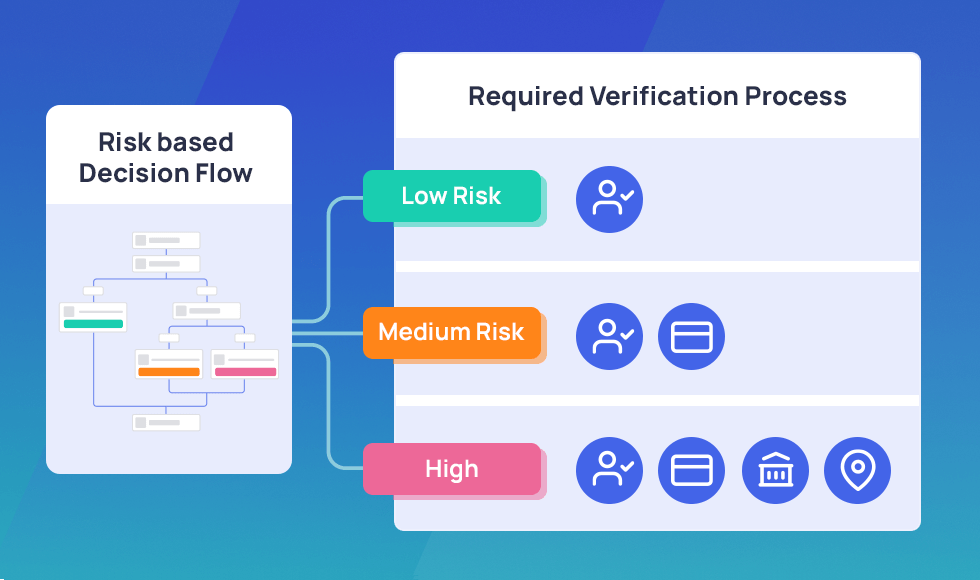

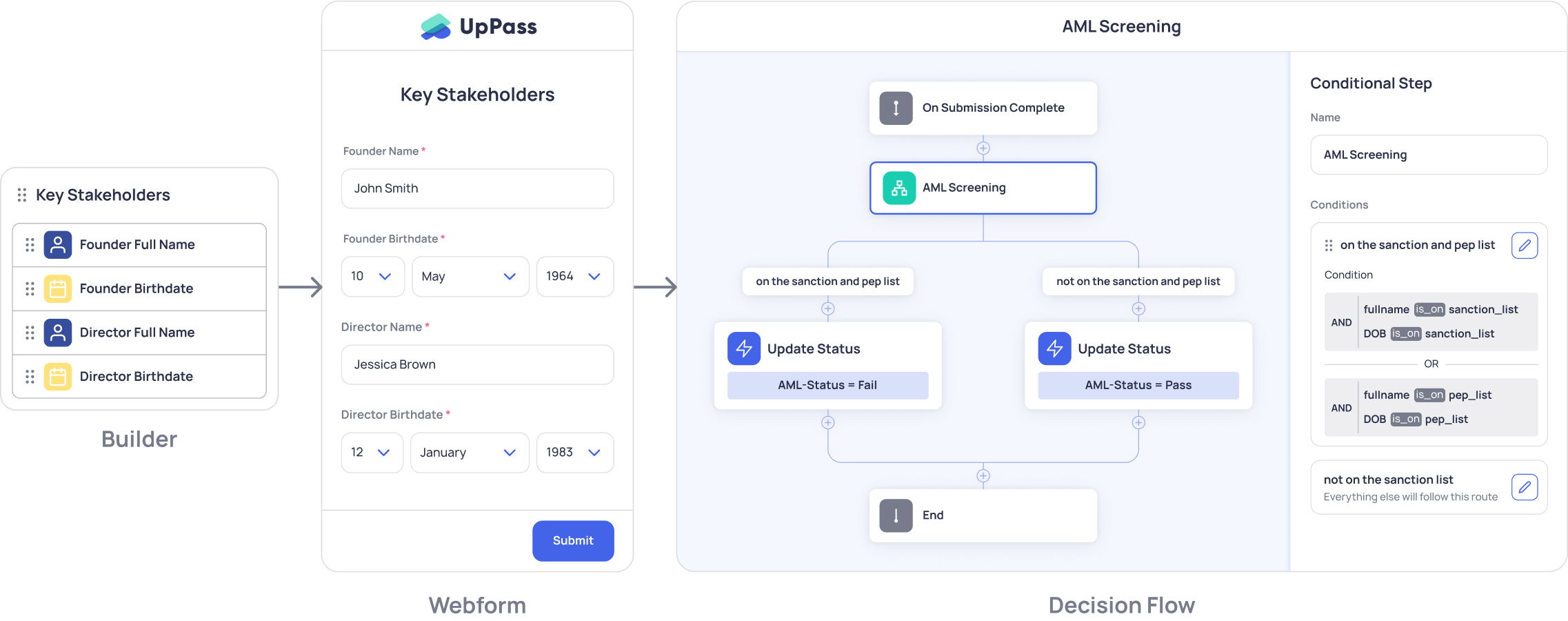

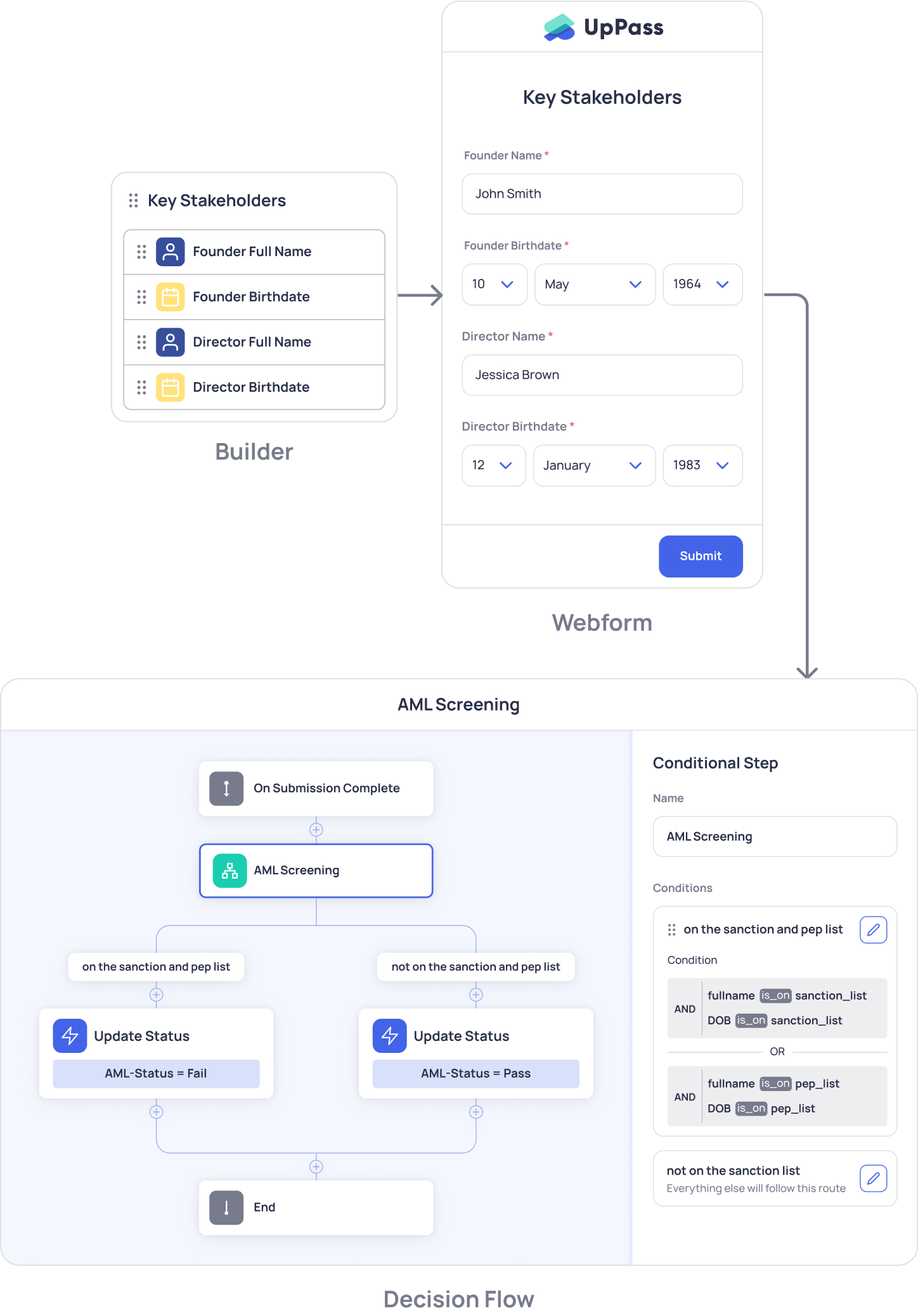

Personalise Risk-Based User Journey

Customise AML screening by identifying conditions aligning with your business's identity fraud tolerance, ensuring a personalized and efficient client onboarding experience.

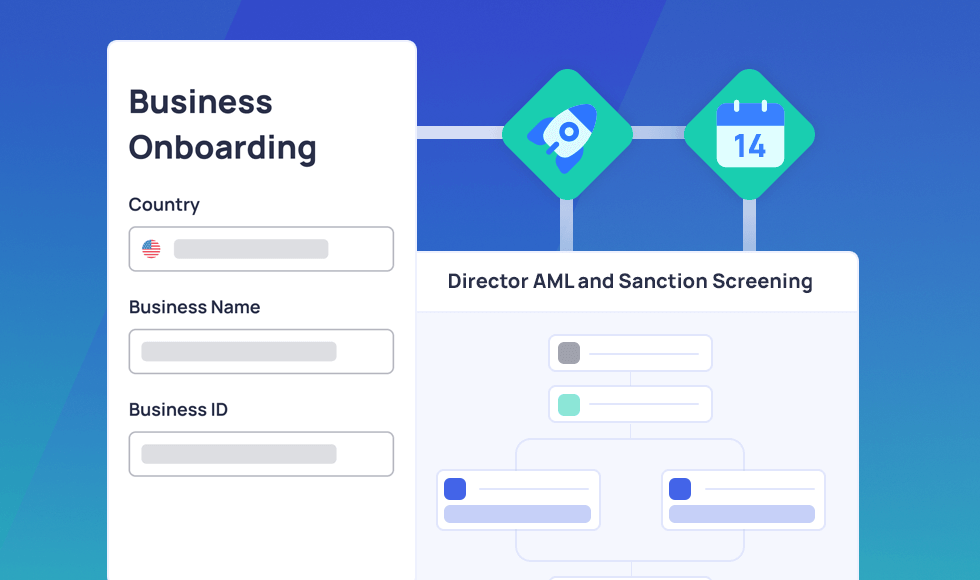

Speed up KYC/KYB Compliance

Quickly and efficiently screen company and business stakeholders with a no-code solution, deploying within two weeks and streamlining vendor evaluation

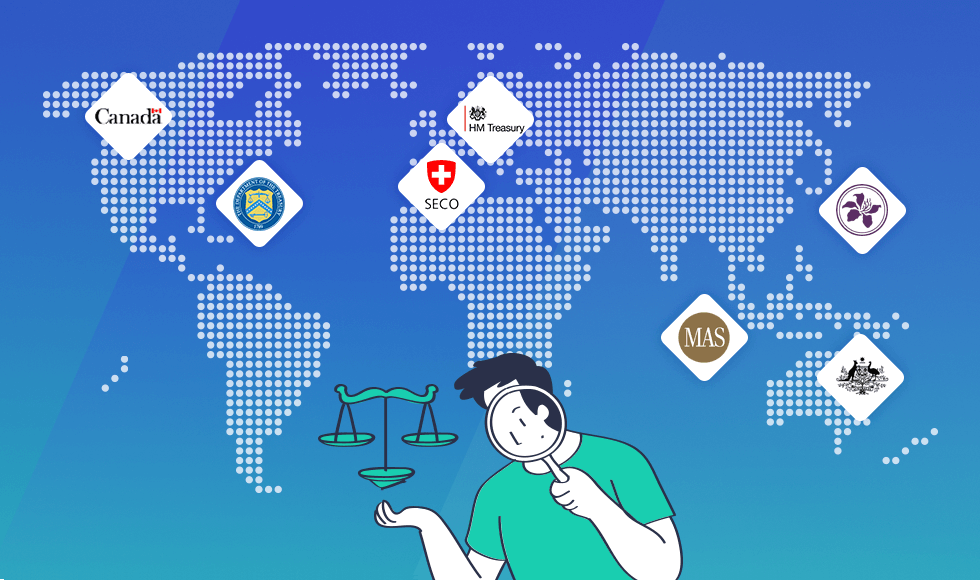

Ensure Global Compliance

Comprehensive global coverage and localized AML compliance enables confident market navigation, regulatory adherence, and seamless connection with diverse audiences.

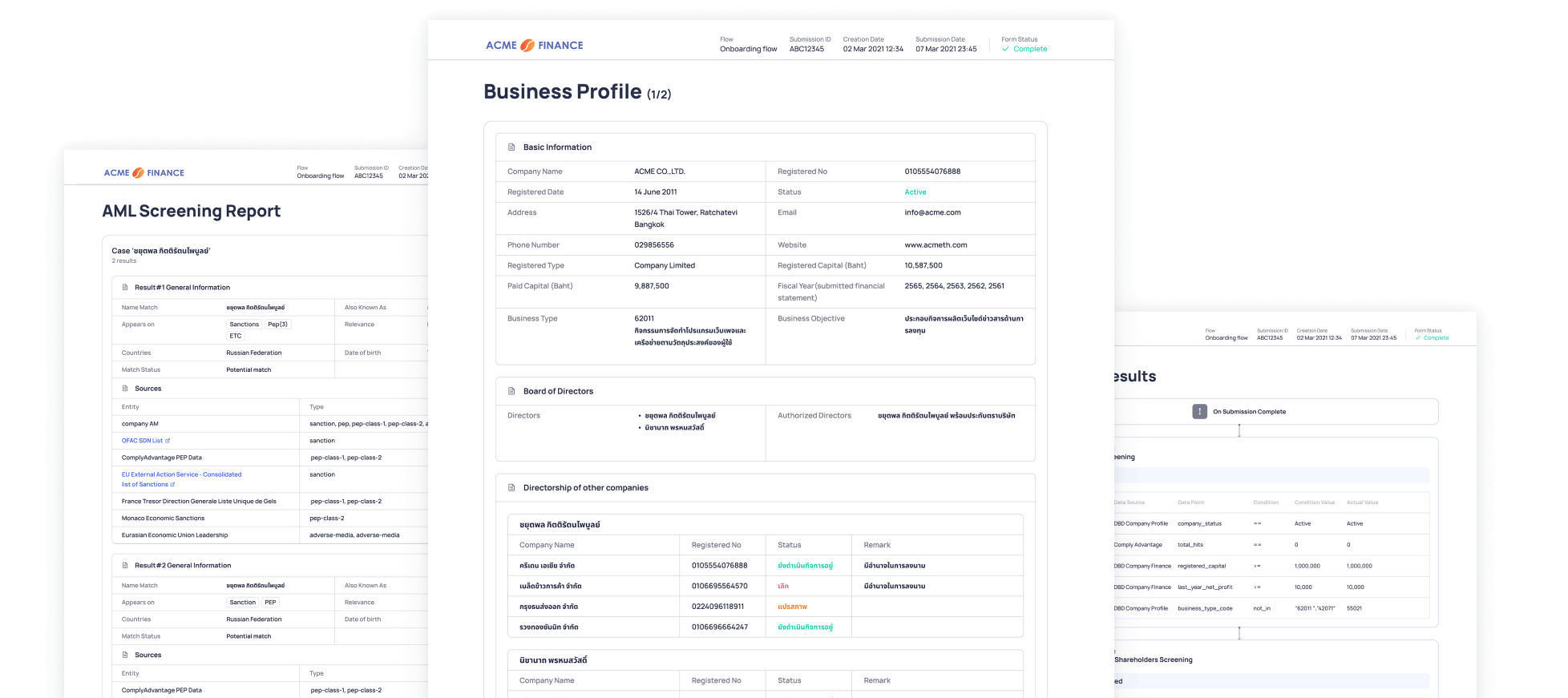

Effortless Compliance Reporting, All In One place

Save days and reduce manual works without development dependencies

Defining the customer journey flow

Personalize customer onboarding triggers, design, and overall user experience,while establishing conditions for accuracy in case of failed validation.

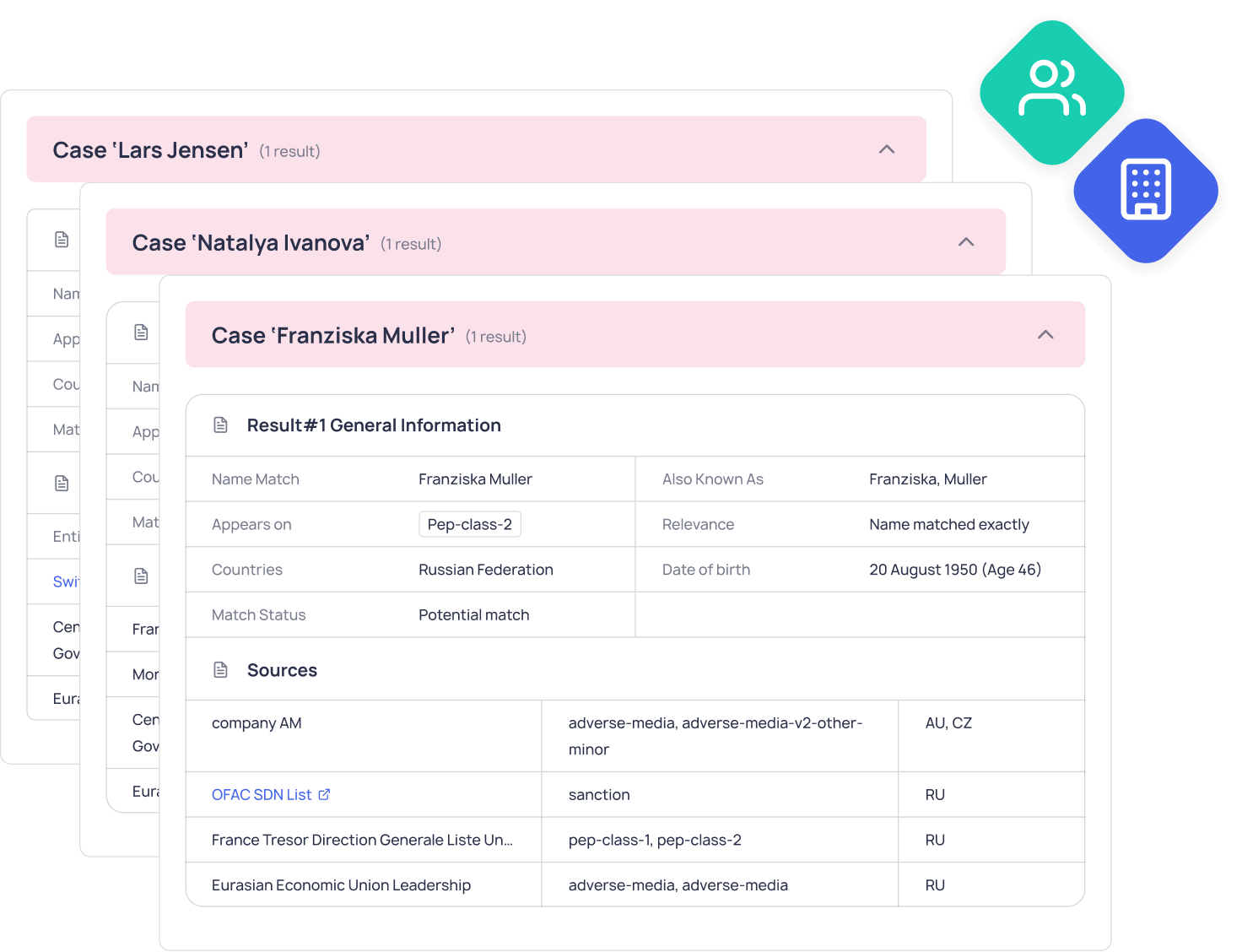

Bulk AML screening for Business and Individuals

Iterate the screening for Shareholders and Directors in bulk, enhancing the speed and accuracy of anti-money laundering compliance measures.

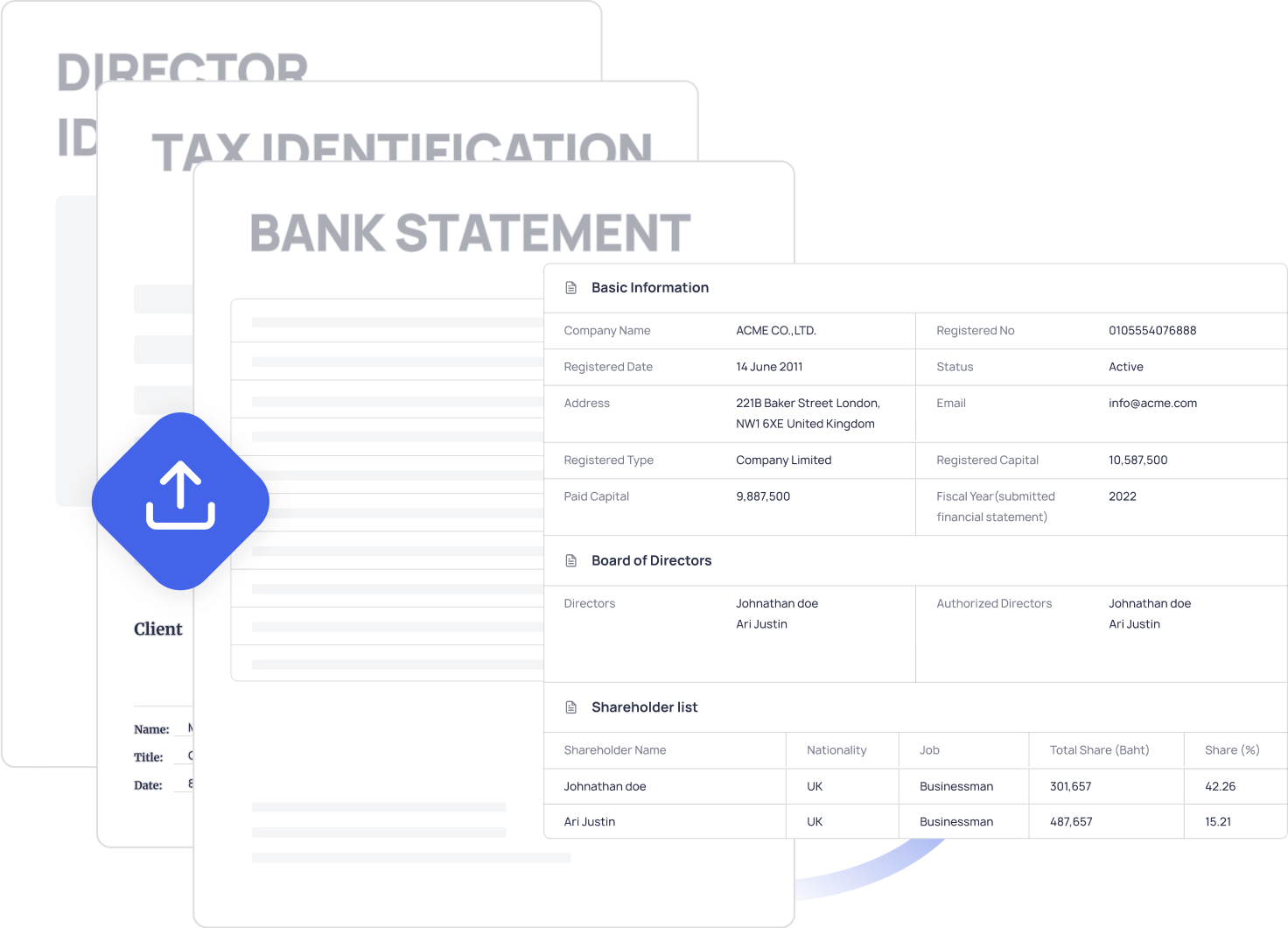

Design ECDD with local financial data connections

Save your manual document requests by automating your Enhanced Customer Due Diligence process end-to-end, collecting and validating an accurate understanding of source of wealth and income, locations, directorship and share ownership

department_01a.svg

department_01a.svg